How to Determine a Property’s Highest & Best Use

This is an often misunderstood aspect of Real Estate. A property’s usage is often confused with the highest & best use of a property. Usage is a part of the highest & best use but there are many other factors that go into determining the highest & best use of a property. Hopefully, we’ll be able to explain it in a way you will understand and recognize in your next deal to make more money.

Highest & Best Use Introduction

To start let me give you the definition as defined by the Appraisal Institute

The reasonably probable and legal use of vacant land or an improved property that is physically possible, appropriately supported, financially feasible, and that results in the highest value. The four criteria the highest and best use must meet are legal permissibility, physical possibility, financial feasibility, and maximum productivity. Alternatively, the probable use of land or improved property – specific with respect to the user and timing of the use – that is adequately supported and results in the highest present value.

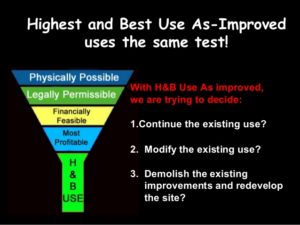

That may not make sense so let me try to explain. In order to determine the Highest & Best Use you have to put a property through a test. It has to pass all categories to be called the highest & best use. If it doesn’t pass all categories it is considered to be in a grandfathered state or interim state. We’ll talk more about those later.

In very simple terms the highest means it has the most value with best meaning no other usage could be better than the current usage. In order to achieve this a property needs to have the correct structure whether house, apartment, office building, farm, etc. For that area it has to make that property worth the most to be the highest. It doesn’t have to be the best if it’s a farm with commercial development moving in. This is where the test come in to determine the highest & best use.

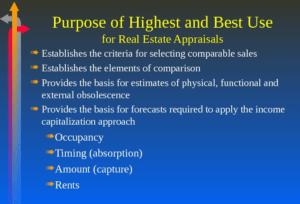

Highest & Best Use Tests

There are four tests to determine a property’s highest & best use.

- Legally Permissible

- Physically Possible

- Financially Feasible

- Maximally Productive

Legally Permissible

In order to be legally permissible you basically have to make sure the property conforms to zoning and regulations. If a new development is proposed but it doesn’t conform to zoning or regulations for the area and parcel it isn’t legally permissible. A property can change zoning to allow for the new development if it passed the highest & best use test in total. Municipalities want to make the most money on taxing property also. When an existing property is grandfathered or zoning changes the property becomes an interim use while being legally nonconforming.

Physically Permissible

This is an obvious category. You can’t build a house, or shouldn’t anyway, on the side of a cliff. I said shouldn’t because people have done it for their own reasons.

You also couldn’t build a 15,000 sq ft warehouse on a 10,000 sq ft lot. Physically permissible is easy to understand.

Financially Feasible

This test tells the story of whether it makes sense to build a structure on a specific parcel in terms of money. If it will cost more to build than it could be sold for it isn’t finally feasible. A developer may be building a revenue generating structure that is intended to provide a monthly revenue. In this scenario being financially feasible will change with every investor and most lenders. This is what determines whether a deal is an investment to most investors. One investor may require a 25% return while another may require a 15% return on their investment. Lending Institutions will also change with this test. The downpayment and loan to value will change depending on the lender of the property.

Maximally Productive

In order to be maximally productive a property must provide the highest net return. This is different than financially feasible. It varies between investors and lenders. Maximally productive makes you the most money on the property.

This test is important in your deals since determining an alternative exit to an investor could potentially be the difference in closing the deal.

This scenario might help show you why using maximally productive in your deals is important.

Single family house

- The market value to a homeowner that will live in the property is $115,000

- The market value of the same property based on an estimated rent amount of $1,500 multiplied by a gross rent multiplier of 80 has an income value of $120,000

This scenario might lead me to believe the area is primarily a rental area with owner occupied homes representing a lessor amount of homes than those being rented.

Understanding maximally productive also allows you to recognize that a property may currently be an interim use. A change may be taking place with the above example showing the sales comparison(Zillow) value versus the income approach values being close to each other. The income value may be declining while the sales comparison increases. If this is happening more owner occupants are returning to the area. To an investor being able to collect rent with a higher retail sales price in a couple of years may be an attractive reason to purchase.

Final Thoughts

Understanding the Highest & Best Use of a property is very important to the success you have in Real Estate. It allows you to see things before they happen because you have knowledge most don’t have in regards to Real Estate. Imagine if you knew a commercial development would be coming soon just from looking at the area. You noticed a trend of property changes headed your direction or you noticed a change in owner occupied versus tenant occupied. Being able to show your investors additional potential exits is always a benefit. Investing in Real Estate is always a risk. When you understand the highest & best use you see Plan B in case Plan A doesn’t work.

I was told by a wise man as a child there were at least 2 legal ways to make money in every Real Estate transaction. The one’s that understand Real Estate can see them. The one’s that can’t see them leave us mailbox money.

That’s a true statement. You may manage a property after you sell it. You might sell the investor another house. It may be immediate and it may takes weeks, months, or years. If you handle the deal correctly there will be a second way to make money on the deal. Be slow in your execution and find it. It’s mailbox money!