What to Expect in a Cash Sale Closing Process

Introduction

When it comes to selling a home, a cash sale is one of the most straightforward and efficient ways to close the deal. The cash sale closing process is relatively simple and involves a few key steps.

First, the buyer and seller will agree to the terms of the sale and sign a purchase agreement. Then, the buyer will deposit the funds into an escrow account held by a title company. The title company will then review the documents and ensure that all of the necessary paperwork is in order. Once the title company has verified that all of the documents are in order, they will release the funds to the seller and the sale will be complete.

Understanding the Cash Sale Closing Process

When it comes to closing a cash sale, the process is straightforward and efficient. As the buyer, you will be responsible for paying closing costs, which typically include a title search and title insurance. The title search will ensure that the seller is the rightful owner of the property and that there are no liens or other encumbrances on the property. Once the title search is complete, the buyer will be issued a title insurance policy, which will protect them from any potential title issues that may arise in the future. The buyer will also need to sign a deed, which will transfer ownership of the property from the seller to the buyer.

By understanding the cash sale closing process, buyers can be confident that they are making a sound investment. With the right preparation and knowledge, buyers can be sure that their purchase is secure and that they are getting the best deal possible.

What Documents are Needed for a Cash Sale Closing?

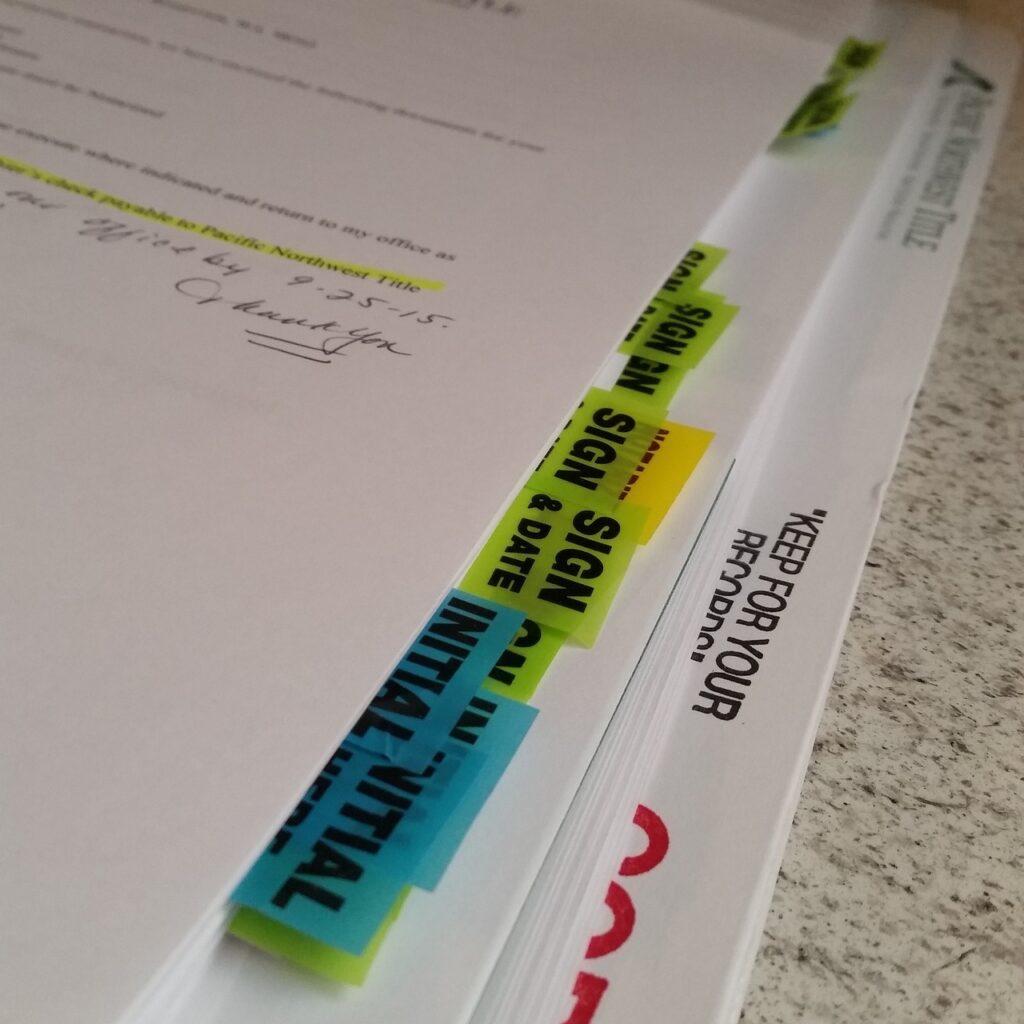

When it comes to a cash sale closing process, it’s important to understand what documents are needed to ensure a smooth and successful transaction. The closing process for a cash sale is typically much simpler than a traditional mortgage closing, as there are fewer documents to sign and fewer closing costs to pay. However, there are still some important documents that must be signed and some closing costs that must be paid.

The most important document that must be signed in a cash sale closing is the deed, which transfers ownership of the property from the seller to the buyer. Additionally, the buyer will need to purchase title insurance, which protects the buyer from any potential title defects that may arise in the future. The buyer will also need to pay closing costs, such as transfer taxes, recording fees, and title search fees.

By understanding the documents and closing costs associated with a cash sale closing process, buyers can be better prepared for a successful transaction. With the right preparation and knowledge, buyers can confidently move forward with their cash sale closing process.

What is the Role of the Buyer and Seller in a Cash Sale Closing?

When it comes to a cash sale closing process, both the buyer and seller have important roles to play. The buyer is responsible for providing the full purchase price in cash, while the seller is responsible for providing the title to the property and any other documents required for the closing. The buyer should also be prepared to pay any closing costs associated with the transaction.

The seller should ensure that all necessary documents are in order and that the title is free and clear of any liens or encumbrances. The seller should also be prepared to provide any additional information that may be required by the buyer or their attorney. Both parties should be aware of any local laws or regulations that may affect the closing process.

By understanding their respective roles in the cash sale closing process, both the buyer and seller can ensure that the transaction is completed in a timely and efficient manner.

What is the Role of the Closing Agent in a Cash Sale Closing?

When it comes to a cash sale closing, the role of the closing agent is essential. The closing agent is responsible for ensuring that all documents are properly signed and that all funds are properly transferred. They will also provide guidance and advice throughout the closing process. The closing agent will review all documents to ensure that they are accurate and complete, and will also provide a closing statement that outlines the details of the transaction.

The closing agent will also ensure that all funds are properly transferred and that the buyer and seller are both satisfied with the outcome of the closing. With the help of a closing agent, the cash sale closing process can be completed quickly and efficiently.

What Happens During a Cash Sale Closing?

When it comes to closing a cash sale, the process is straightforward and efficient. The buyer pays the full purchase price in cash, and the seller transfers the title of the property to the buyer. The closing costs associated with a cash sale are typically lower than those associated with a mortgage, as there is no need for a title search or title insurance. The deed is prepared and signed by both parties, and the buyer takes possession of the property.

The cash sale closing process is relatively simple and can be completed quickly. Buyers should be aware of the closing costs associated with the sale, and should be prepared to pay the full purchase price in cash. Additionally, buyers should be aware of the need for a title search and title insurance, and should be prepared to sign the deed in order to take possession of the property.

Tips for a Smooth Cash Sale Closing Process

When it comes to closing a cash sale, the process can be relatively straightforward. However, it is important to be aware of the various closing costs and other factors that may come into play. To ensure a smooth closing process, it is important to understand the various closing costs associated with a cash sale, such as title insurance and home inspection fees.

Additionally, it is important to be aware of any potential issues that may arise during the closing process, such as title issues or other legal matters. By being aware of these potential issues, you can ensure that the closing process goes as smoothly as possible.

Conclusion

In conclusion, the cash sale closing process is a complex but necessary step in the home buying process. It is important to understand the roles of the buyer, seller, and closing agent, as well as the documents needed for a successful closing. By following the tips outlined in this article, buyers and sellers can ensure a smooth and successful cash sale closing process.

Ultimately, the cash sale closing process is an important part of the home buying process and should be taken seriously. With the right preparation and understanding of the process, buyers and sellers can make the most of their cash sale closing experience.

Frequently Asked Questions

Q1: What is a cash sale closing process?

A1: A cash sale closing process is the final step in a real estate transaction where the buyer pays the seller in full for the property. The closing process involves the buyer, seller, and closing agent, and includes the signing of documents and the transfer of funds.

Q2: What documents are needed for a cash sale closing?

A2: The documents needed for a cash sale closing include the deed, title, and closing statement. The deed is a legal document that transfers ownership of the property from the seller to the buyer. The title is a document that proves the seller has the right to sell the property. The closing statement is a document that outlines the financial details of the transaction, including the purchase price, closing costs, and any other fees associated with the sale.

Q3: What is the role of the buyer and seller in a cash sale closing?

A3: The buyer and seller both have important roles in a cash sale closing. The buyer is responsible for providing the funds for the purchase and signing the necessary documents. The seller is responsible for signing the deed and other documents, and transferring the title to the buyer.

Q4: What is the role of the closing agent in a cash sale closing?

A4: The closing agent is responsible for overseeing the entire cash sale closing process. The closing agent will review all documents, ensure that all parties have signed the necessary documents, and facilitate the transfer of funds.

Q5: What happens during a cash sale closing?

A5: During a cash sale closing, the buyer and seller will sign all necessary documents, including the deed and closing statement. The closing agent will review all documents and ensure that all parties have signed them. The closing agent will also facilitate the transfer of funds from the buyer to the seller.

Q6: Are there any tips for a smooth cash sale closing process?

A6: Yes, there are several tips for a smooth cash sale closing process. First, make sure to review all documents carefully before signing them. Second, be sure to have all necessary funds available before the closing date. Third, be sure to communicate with all parties involved in the transaction to ensure that everyone is on the same page. Finally, be sure to work with a reputable closing agent who can guide you through the process and address any potential issues that may arise.

Did You Know?

EarlToms would like to make an offer on your house. We pay cash so you won’t have any appraisals, home inspections, agent commissions, or closing fees typically associated with selling your house to EarlToms. If you want to sell your house, in a hassle-free way, simply fill out the form to get started.