What are the ways to avoid foreclosure?

Introduction

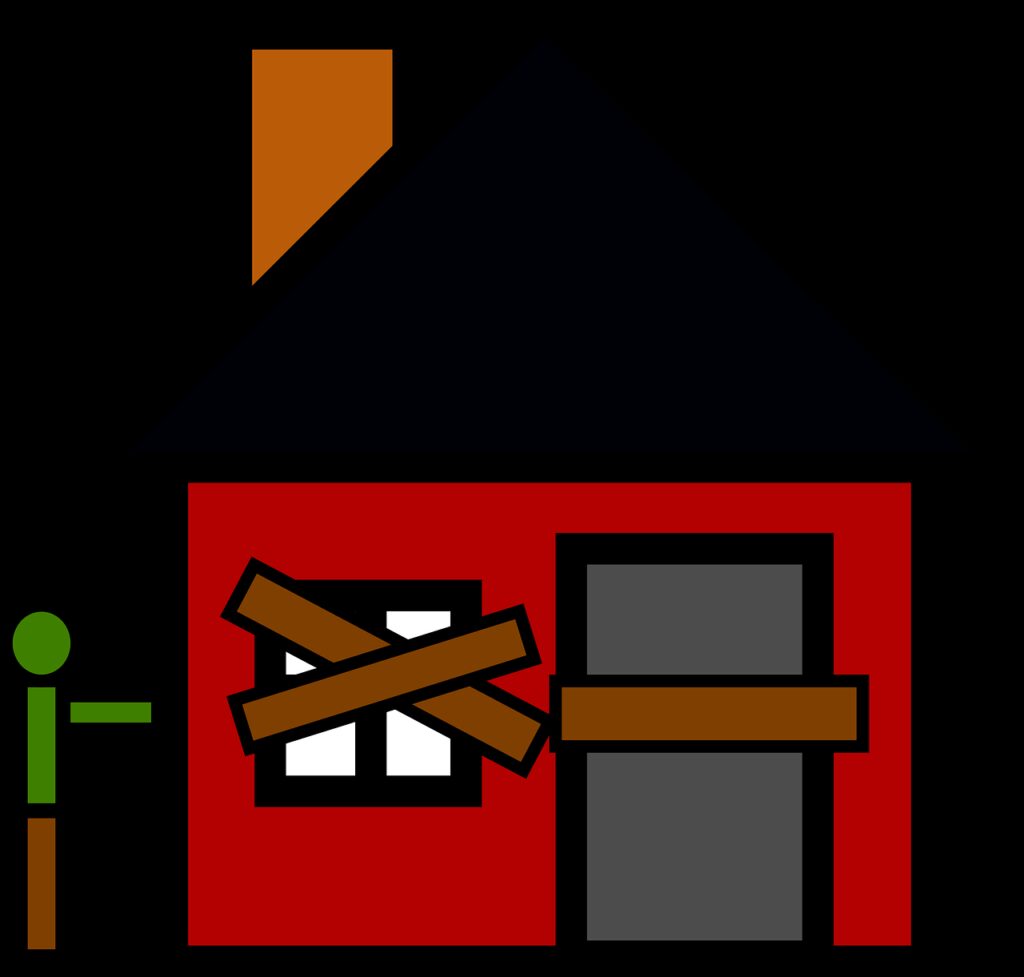

Homeowners across America are struggling to keep up with their mortgage payments. Foreclosure rates have been on the rise in recent years. If you’re behind on your mortgage payments, you may be wondering what options you have to avoid foreclosure.

Foreclosure is a process that allows a lender to take back a property if the owner has failed to make mortgage payments. The foreclosure process can be long and stressful, so it’s important to understand your rights and options before it begins. Keep reading to learn more about ways to avoid foreclosure.

Understand your mortgage terms and conditions

Taking out a mortgage is a big decision, so it’s essential to ensure that you are aware of the full terms and conditions of the loan. Understanding your mortgage contract helps protect both you and your lender; after all, ensuring everything is fair for both sides means everyone will be happy with their agreement in the long term.

Before signing any paperwork, make sure that you’ve reviewed all the loan details and payment plans thoroughly — compare against national standards if you’re unsure — and factor in insurance coverage as well. Doing your homework ahead of time will benefit you further down the line, so take the time to understand your mortgage details today.

Know your rights as a borrower

As a borrower, it is important to familiarize yourself with your rights under the law. You are legally entitled to clear and accurate information about your loan, such as the terms and conditions, the total amount due, and the applicable interest rate. You must also be informed of all costs associated with your loan before signing any documents.

Once a loan has been taken out, you have the right to repayment plans in the event of payment difficulties, as well as debt counseling to help identify financial problems and resolve them. Knowing your rights is key to preventing irresponsible lending practices and managing your finances responsibly.

Communicate with your lender

One of the most important things when managing your finances is to communicate effectively with your lender. Keeping them informed of any changes in circumstances, or other factors that may affect your ability to repay your loan can help you keep on top of things better. Having an open and honest relationship with your lender is key. You should be professional yet cordial in all communications, making sure to read any fine print clearly and confirm details before signing anything.

It’s also important to be aware that lenders can change conditions that affect you at any time and make sure you are clear on what the alterations mean for you. Doing this will ensure a smoother repayment process in the long run by keeping both parties ‘in the know’.

Prioritize your spending

Learning to prioritize your spending is an essential lesson in managing money properly. Therefore, it’s important to set aside time each month to review your financial situation and develop a clear strategy for how you spend your income. Having a budget is a great place to start, but actively keeping track of the expenses you make – both necessary and discretionary – is even more useful. Considering what you can afford, both now and down the road, will help you focus on the purchases that matter most instead of financial splurges that leave you broke later.

Seek professional help

Seeking professional help is an important step to understanding and manage difficult emotions, personal problems, and mental health concerns. A trained therapist can provide guidance, advice, and support as you work through life’s inevitable challenges. Professional therapy sessions can help reduce stress; offer practical solutions; identify negative thinking patterns; increase self-awareness; develop healthier perspectives and relationships, and ultimately lead to a more fulfilling and meaningful life.

Additionally, therapy can address underlying issues that form the basis of certain behaviors or habits that people may find it difficult to change on their own. For these reasons, seeking professional help can be a positive step towards creating better mental health outcomes in life.

Conclusion

It’s difficult to keep up with mortgage payments, especially when other aspects of life get in the way. However, there are steps you can take to make things a little easier on yourself and ensure that you’re not taken advantage of by your lender. First and foremost, be sure that you understand all the terms and conditions of your mortgage agreement so that you know exactly what is expected of you as a borrower.

Secondly, always stay aware of your rights – you have more power than you may think when it comes to working with your lender. If negotiations seem to be going nowhere, seek professional help from a housing counselor or attorney who can advocate on your behalf.

Lastly, remember to prioritize your spending to make room for essential expenses like keeping a roof over your head. We hope these tips were helpful; if you find yourself struggling despite taking these measures, EarlToms may be able to buy your house before foreclosure proceedings begin. Give us a call today for more information about our services.

Did You Know?

EarlToms would like to make an offer on your house. We pay cash so you won’t have any appraisals, home inspections, agent commissions, or closing fees typically associated with selling your house to EarlToms. If you want to sell your house, in a hassle-free way, simply fill out the form to get started.